Beyond the Bike

Re-introducing the Economic Cycle: Lessons from the Financial Crisis

Welcome to the Next Revolution of the Economic Cycle! For new readers, I’m a former city economist (2001-2009) turned teacher who decided back in 2011 to cycle my tandem bicycle back to London from South Africa in an attempt to understand a bit more about our dismal science. The blog used serendipitous encounters with locals to tell the stories of economics in Africa. Topics ranged from how economists value life (based on a high speed accident with a taxi in South Africa) to how religion and mobile phones have shaped economic development.

An investigation into the Value of Life in Africa; Mungwe the Masai equipped with sword, staff & mobile phone

Beyond the Bike – The Next Revolution

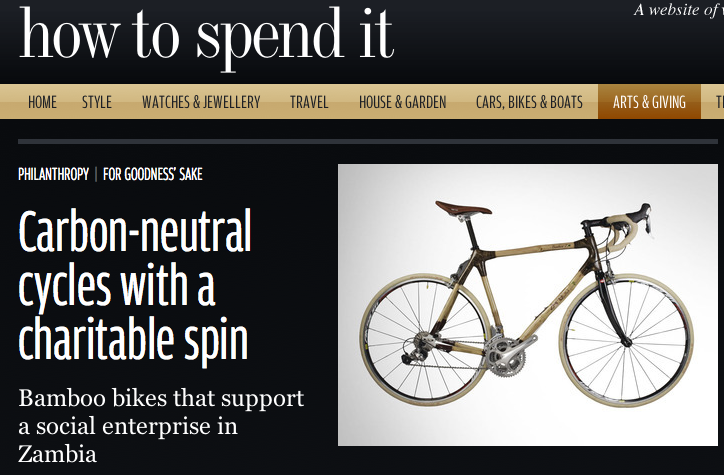

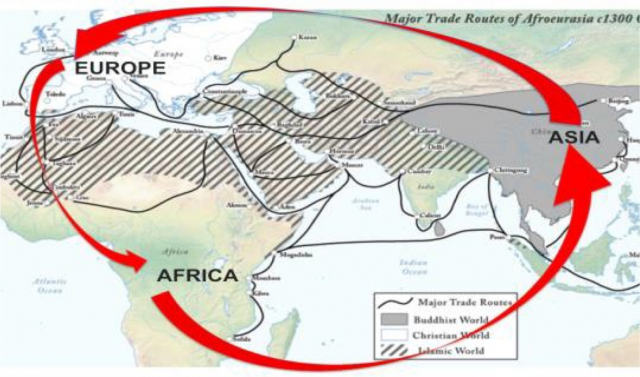

Starting in September this year, I’m going to be riding with my girlfriend Claire to China along new and old ‘silks roads’. In order to keep the back seat of the tandem free, she’s going to be riding an African made Bamboo bike! We’re going to be following the journey of key resources that are used to produce smartphones from African mines to Chinese factories and back to Europe and the rest of the world as finished products. We’re excited to be partnering with Tutor 2U, The Royal Economic Society and Fairphone, a mobile phone company that puts social values first. You can read more about the project on our website.

Bamboo Bikes featured in the Financial Times; A choice of new & old ‘silk routes’ in an ‘economic cycle’, exploring the journey of gold, copper & other resources from Africa to Asia & back to Europe.

The next revolution of the economic cycle blog will be recorded using the latest Fairphone. As well as considering issues around the supply chain of smartphones, I’ll be keeping the back seat of my tandem free to meet locals, from policymakers to street vendors, bringing relevant regional economic themes to life for readers of the blog.

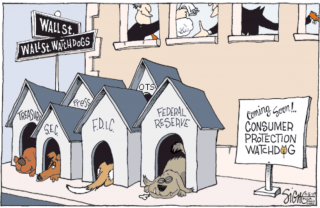

Lessons from the Financial Crisis as viewed from a local classroom

I’m writing this first blog sitting in my classroom in Tower Hamlets with my old office in Canary Wharf visible through the window. This is a borough that epitomises the global economy today: thanks to Canary Wharf being located within Tower Hamlets, it has the highest average earnings of employees WORKING in the borough in the whole of the UK. However, household income of those LIVING here is the lowest in London. 65% of students at my school are entitled to free school meals. At times, the thriving, mainly Bengali community feels a million miles apart from the gleaming offices just down the road. With financial markets panicking as Greece lurches closer to Grexit and having recently presented to a teacher conference on lessons from the financial crisis, it seems appropriate to focus on this as the subject for my first blog. In the lecture (slides are linked below), I focused on 10 lessons ranging from ‘taking care to trust your banker’ (ok, so an easy swip at my former profession) to issues around the effectiveness of policy in solving the monumental market failures that occurred pre, during and since the crisis.

Lesson no 1 – Don’t trust your banker; Lesson no 2 – the Regulation failed!

I think that the most important lesson, however, is that the economics profession itself needed a good long hard look in the mirror. Macro-economists, in particular, were becoming too driven by Maths and econometric models. Maths is hugely useful but too much confidence was being placed in models when the complexity of what was being forecast led to huge margins of error. Keynes told us that ‘the study of economics does not seem to require any specialized gifts of an unusually high order’. An economist, therefore needs to be somewhat of a jack-of-all-trades – ‘part mathematician, historian, statesman, philosopher… understanding symbols but speaking in words’[1].

Thankfully, the views of Britain’s most famous 20th Century economist have been heard again after a long period of being out of fashion. This has trickled down into the new A-level syllabus, for example, which has more behavioural economics; a new look at financial markets and a better appreciation of history.

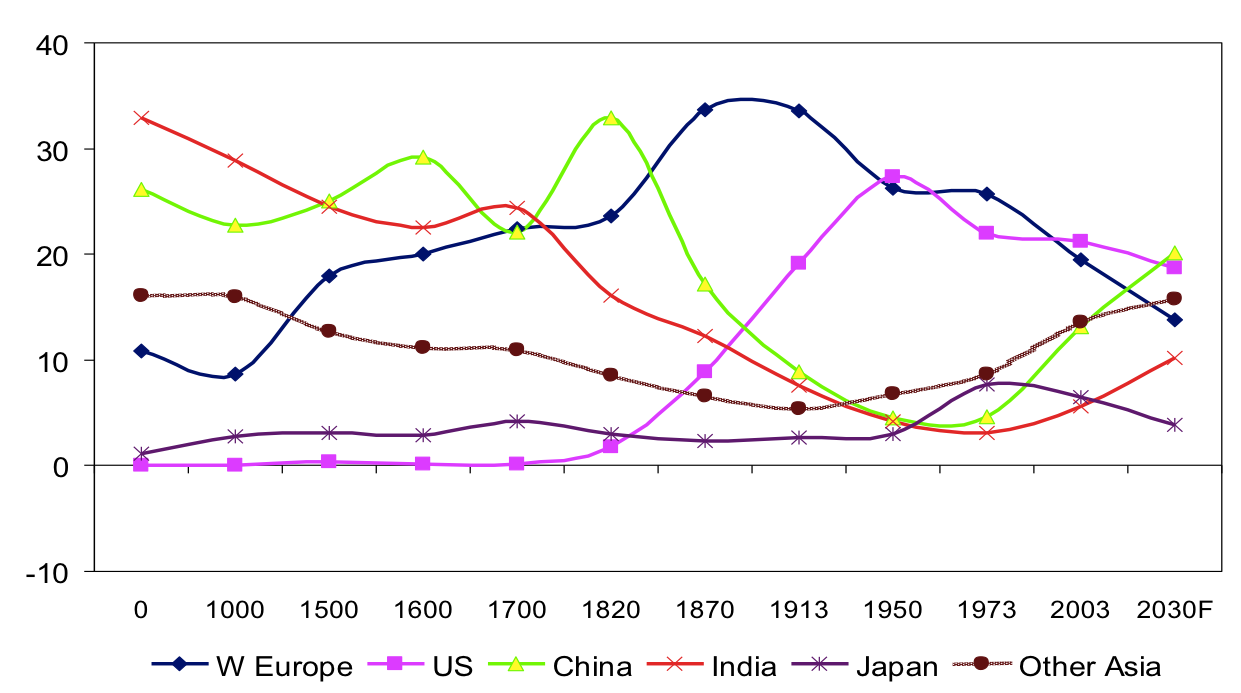

Linked to this point, whilst many economists and policymakers correctly used comparisons with the 1930s to avoid a full repeat of the great depression, the crisis has accelerated the shifting balance in the world economy from West to East. China, closely followed by India, is soon to be the biggest economy in the world. Interestingly, this was the status quo for the first millennium (see chart below). As Clarence Darrow once said, ‘History keeps repeating itself. That’s one of the things wrong with history.’

Shares of Individual Economies in the World. GDP measured in PPP%

Source: Citi estimates based on original data from Angus Maddison, 2001, The World Economy: A Millennial Perspective, Development Research Center, OECD, Paris, and Angus Maddison, 2005, "The west and the rest in the world economy: 1500-2030", Australian National University, Canberra.

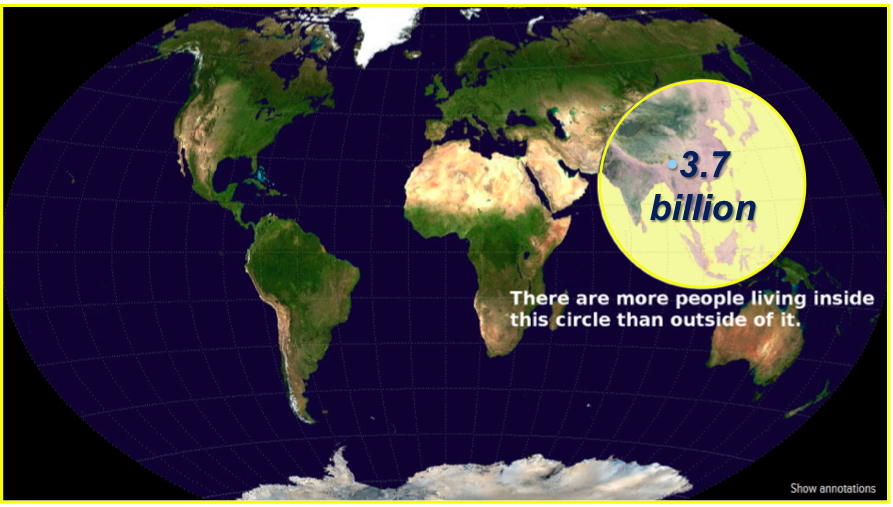

With over ½ of the world’s population living in South East Asia today, to fully understand the future of the humanity and the world economy, the economic cycle needs to get go East. I hope you can join us on this journey!

.Asia – the centre of population gravity. Remarkably, 2/3 of the circle above is water

Have a look at the slides from my lecture here: Tutor_2U_Financial Markets

[1] J. M. Keynes "Alfred Marshall, 1842-1924" The Economic Journal, (Sept.,1924)

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.